SmartCash is an app that offers users the convenience, safety, and security of cash or online cash loans. Users can build their credit line and reduce interest rates by making on-time loan repayments or completing tasks to increase their credit limit. Only those who are 18 years old and above and citizens of Ghana with a regular source of income are eligible to use SmartCash. With just one mobile device, users can apply for loans anywhere at any time through a 100% online process. The loan amounts range from GHS1,000 to GHS50,000, with loan terms from 91 days to 360 days, and interest rates from 10% to 25% per annum. The maximum annual interest rate (APR) is 25% with no service charges. Customers' information is secured via a 256-bit SSL encryption, and their data will not be shared with any third party.

The advantages of SmartCashAPP software are as follows:

SmartCash has been a lifesaver for me! The ability to build credit and lower interest rates by completing tasks is a game-changer. I've managed to improve my financial situation significantly. The only downside is occasional slow response times.

La aplicación SmartCash es útil, pero a veces la interfaz es un poco confusa. He podido aumentar mi línea de crédito, pero los tiempos de carga son lentos. Aún así, es una buena opción para manejar mis finanzas.

SmartCash m'a permis d'améliorer ma cote de crédit de manière significative. Les tâches pour augmenter ma limite de crédit sont intéressantes, mais l'application pourrait être plus rapide. Globalement, je suis satisfait.

Forsaken Characters Ranked: Tier List Update 2025

State of Play Reveals Exciting Updates: PlayStation February 2025 Showcase

How to Use Cheats in Balatro (Debug Menu Guide)

Infinity Nikki – All Working Redeem Codes January 2025

Roblox: Obtain Secret Codes for January 2025 (Updated)

Pokémon GO Raids in January 2025

Wuthering Waves: Redeem Codes for January 2025 Released!

LEGO Ninjago Sets Top the Charts (2025)

The Outer Worlds 2: Your Journey Begins With Your Build

Feb 22,2026

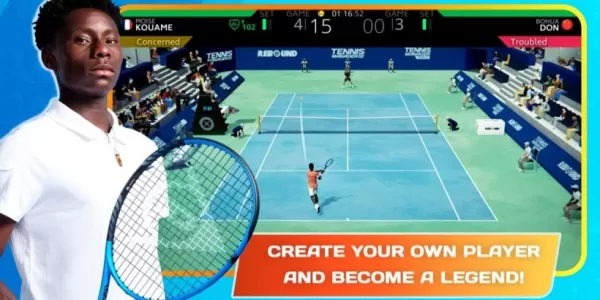

Tennis Manager 25 Pre-Registration Opens on Mobile

Feb 21,2026

Battlefield 6 Beta Expands With Custom Search, Playlists

Feb 19,2026

Dragon Raja Launches YoYo Summer Carnival Update

Feb 18,2026

Samsung Galaxy Buds 3 58% Off in Labor Day Sale

Feb 11,2026

Streamline your social media strategy with our curated collection of powerful management tools. This guide features popular apps like TikTok Studio for content creation and analytics, Instagram for visual storytelling, Facebook Gaming for live streaming, Twitter Lite for efficient tweeting, and more. Discover how Likee, WorldTalk, Quora, Moj, Amino, and Live.me can enhance your social media presence and help you connect with your audience. Learn tips and tricks to manage multiple platforms effectively and maximize your reach. Find the perfect tools to boost your social media success today!

Live.me

WorldTalk-Date with foreigners

Facebook Gaming

Instagram

Likee - Short Video Community

Quora

Twitter Lite